어스틴 (오스틴) 텍사스 부동산 뉴스 & 소식 (주택, 집, 콘도, 타운홈, 상업용 부동산)

Office market sets another record

Office market sets another record

Rents, occupancies for premium space at 5-year high

AMERICAN-STATESMAN STAFF

Wednesday, January 03, 2007

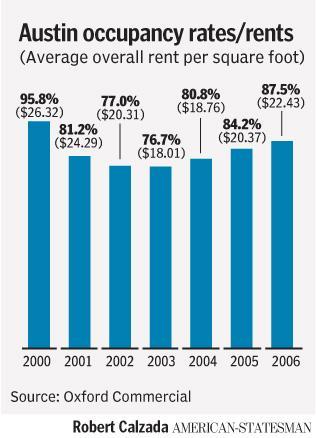

Central Texas' office market continued to strengthen in late 2006, pushing rents and occupancies for premium office space to their highest levels in more than five years, new figures show.

Job growth is still fueling demand in the Austin area, where the office market has been rebounding since mid-2004 after massive job losses stemming from the 2001 tech bust.

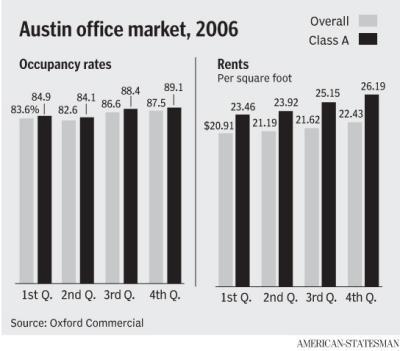

At year's end, tenants occupied nearly 90 percent of space in the area's first-class (Class A) office buildings, compared with about 85 percent in the year-earlier period, the lowest level since early 2001. That's according to figures released Tuesday by Oxford Commercial, an Austin-based real estate brokerage.

Rents for top-quality space stood at $26.19 per square foot, up 15 percent from late 2005.

Citywide, occupancy rates for all types of space also reached their highest levels since early 2001. Tenants filled nearly 88 percent of the region's office space in late 2005, up from about 84 percent at the end of 2005.

Overall, rents climbed to an average of $22.43 a square foot, up 10 percent from $20.37 at the end of 2005, Oxford Commercial said.

Downtown had the highest average rental rate, $26.44. Rents for first-class space downtown rose to $29.38, a five-year high.

"In 2006 the Austin office market stood out as one of the strongest in the United States," Oxford Commercial's report said. "New office construction costs, lower vacancy rates and consistent demand have paved the way for higher rental rates. In addition, record-breaking sales of office buildings have forced operating expenses, which include property taxes, to escalate."

In 2006, 17 office buildings of more than 50,000 square feet changed hands in the Austin area. The highest-profile sale came in August, when Chicago-based Equity Office Properties Trust paid $188 million for Austin's tallest office building, the Frost Bank Tower. At $354 a square foot, the sale set a Texas record.

"Bullish investors are paying big dollars, and they expect rents to increase to justify their purchase prices," said Ford Alexander, a partner and co-founder of Oxford Commercial.

By late 2006, tenants filled about 800,000 more square feet of space than they did a year earlier. Most of that space is being taken by small- to medium-size local companies that are growing as opposed to large company expansions into the market, Alexander said.

But "there are hints of a couple of larger companies with hundreds of jobs looking at Austin currently," he said, although he declined to elaborate.

Most of the leasing activity was in Southwest Austin, where only 6.3 percent of office space is empty and where the bulk of office construction is taking place.

"We're at the cusp of shifting more to a landlord's market, certainly in the southwest," Alexander said. "With minimal vacancy, landlords are driving prices higher," as are higher overall operating expenses because of increased taxes.

Two new office buildings opened in late 2006, adding 167,500 square feet. And several more buildings, part of about 1.1 million square feet of current office construction, are set to open in 2007, Oxford reports.

Alexander said that with the buzz continuing about Austin, which is on numerous lists for best places to live and do business, and with the region projected to add about 20,000 jobs this year, "2007 looks to be a good year for job growth from within Austin and for new companies moving into Austin."

| Number | Thumbnail | Title | Author | Date | Votes | Views |

| 640 |

|

admin

|

2026.02.25

|

Votes 0

|

Views 104

|

admin | 2026.02.25 | 0 | 104 |

| 639 |

|

admin

|

2026.02.25

|

Votes 0

|

Views 102

|

admin | 2026.02.25 | 0 | 102 |

| 638 |

|

admin

|

2026.02.24

|

Votes 0

|

Views 106

|

admin | 2026.02.24 | 0 | 106 |

| 637 |

|

admin

|

2026.02.24

|

Votes 0

|

Views 118

|

admin | 2026.02.24 | 0 | 118 |

| 636 |

|

admin

|

2026.02.24

|

Votes 0

|

Views 115

|

admin | 2026.02.24 | 0 | 115 |

| 635 |

|

admin

|

2026.02.24

|

Votes 0

|

Views 98

|

admin | 2026.02.24 | 0 | 98 |

| 634 |

|

admin

|

2026.01.17

|

Votes 1

|

Views 253

|

admin | 2026.01.17 | 1 | 253 |

| 633 |

|

admin

|

2025.12.08

|

Votes 0

|

Views 465

|

admin | 2025.12.08 | 0 | 465 |

| 632 |

|

admin

|

2025.12.08

|

Votes 0

|

Views 400

|

admin | 2025.12.08 | 0 | 400 |

| 631 |

|

admin

|

2025.12.07

|

Votes 0

|

Views 255

|

admin | 2025.12.07 | 0 | 255 |

| 630 |

|

admin

|

2025.12.06

|

Votes 5

|

Views 306

|

admin | 2025.12.06 | 5 | 306 |

| 629 |

|

admin

|

2025.10.16

|

Votes 0

|

Views 506

|

admin | 2025.10.16 | 0 | 506 |

| 628 |

|

admin

|

2025.09.23

|

Votes 0

|

Views 608

|

admin | 2025.09.23 | 0 | 608 |

| 627 |

|

admin

|

2025.08.19

|

Votes 0

|

Views 683

|

admin | 2025.08.19 | 0 | 683 |

| 626 |

|

admin

|

2025.08.19

|

Votes 0

|

Views 609

|

admin | 2025.08.19 | 0 | 609 |